Life insurance is often overlooked as a vital component of a comprehensive financial plan. But in reality, it should be an essential part of any wealth-building strategy. In its essence, life insurance is a contract between you and an insurance company. You pay a small amount of money, called premiums, and in exchange, the insurance company guarantees a payout to your beneficiaries upon your death.

The day life insurance companies pay death benefits is often the most significant financial event in someone's life. These policies provide a guaranteed payout, regardless of how long you've been paying premiums or how much you've paid in total. The amount can vary from a small amount to a large amount depending on the type of policy and coverage you choose. There are two main categories: term and permanent insurance.

Term life insurance provides coverage for a fixed period of time (10 years, 20 years), while permanent insurance lasts for your entire lifetime. Within these categories are additional options such as fixed period term or universal life insurance plans. While each type has its advantages and disadvantages, the important thing is to have some form of coverage that fits your needs and goals so that you can achieve financial freedom buy reducing uncertainty about what would happen if something were to happen to you unexpectedly.

Suggestion: Life Insurance Policy Anymore Sell

Term vs. Permanent Life Insurance

When it comes to life insurance, there are two main types: term life insurance and permanent life insurance. The primary difference between the two is that term life insurance covers a set period, while permanent life insurance lasts for the policyholder's entire life. For those looking for affordable life insurance coverage, term life insurance differs from permanent life in that it is often less expensive, as it only covers a specific number of years.

One of the main benefits of permanent life insurance is that it provides a death benefit regardless of when the policyholder dies. With term life insurance, if the policy expires before the policyholder passes away, there is no payout to beneficiaries. However, with expired permanent life insurance stays in place until the policyholder pays their premiums or cancels their policy.

The decision to choose between term and permanent life depends on your financial situation and what you're purchasing it for. If you're primarily interested in protecting your family and children (especially those under 2-4 years old) who have custodial responsibilities, then term may be sufficient because they will likely grow up to support themselves financially one day. In contrast, if you're more interested in building cash value over time or name beneficiaries standard final expense or small death benefit needs then going with Permanent Life Insurance would be better suited for you.

Discovering the Advantages of Having Life Insurance

Life insurance can offer peace of mind and financial security for your loved ones in case something unexpected happens to you. One of the most significant benefits of life insurance is that it can cover final expenses such as medical bills and funeral costs, which can be a significant burden for your family during a difficult time. A burial policy, for example, is a type of life insurance specifically designed to cover funeral expenses.

There are two main types of life insurance: standard term policies and permanent life policies. While term policies provide coverage for a specific period, permanent life policies offer cash value and supplement retirement savings. Variable life insurance also offers cash value along with investment options that can increase the death benefits over time. Overall, having life insurance ensures your loved ones are not left financially vulnerable in case of your sudden passing.

Why Your Life Insurance Costs More Than Others

Life insurance premiums vary from person to person, and there are several reasons why your premium might be higher than someone else's. Age is a significant factor in determining life insurance premiums; the older you are, the more expensive your policy will be. Gender also plays a role, with females generally paying less than males for life insurance. If you're a smoker, smoking increases premiums because it's considered risky behavior that could lead to health problems.

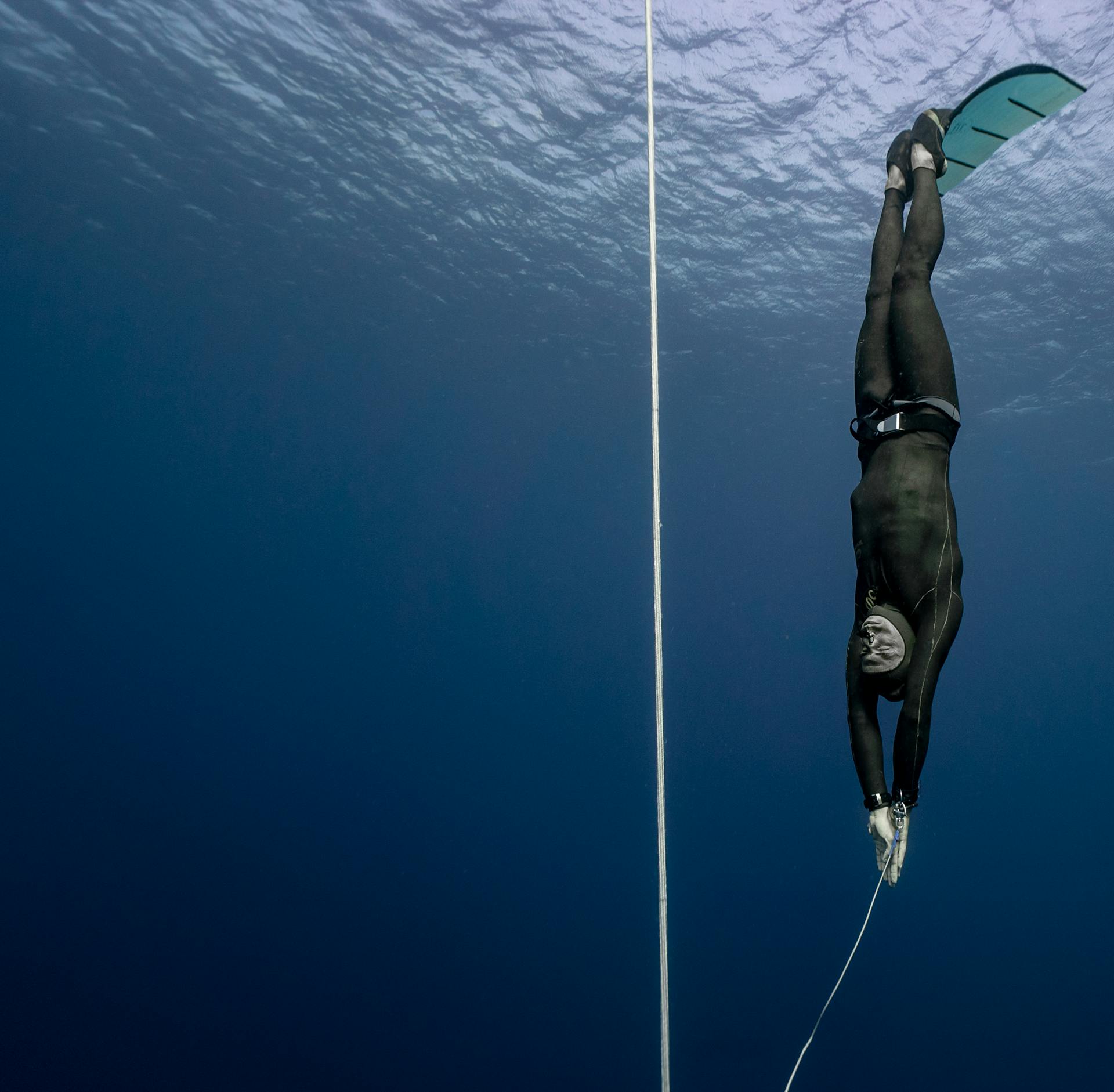

Poor health can also raise premiums since insurers consider the likelihood of paying out a claim higher if the policyholder has existing health issues. Lifestyle choices such as engaging in risky activities like extreme sports or having an occupation that involves physical danger can increase premiums as well. Family medical history of chronic illness can also raise premiums since there's an increased risk of the policyholder developing those same illnesses.

Even something as seemingly unrelated as driving record can affect life insurance premiums. Good drivers save money on their policies since they're seen as safer and less likely to engage in risky behavior behind the wheel. Ultimately, the cost of your life insurance policy depends on several factors, so it's important to shop around and compare quotes to ensure you're getting the best deal possible.

Understanding Life Insurance: A Comprehensive Guide

Purchasing life insurance can provide a safety net for your loved ones in the event of your unexpected passing. A life insurance policy is a contract stating that upon your death, a death benefit payout will be given to your chosen beneficiaries. This payout can be used to cover final expenses, paying off outstanding debt, and even everyday costs that would have been covered by your income. Understanding the different types of life insurance policies available can help you make an informed decision on which plan best suits your needs.

Discover the Ideal Life Insurance Plan for You

Life insurance is a critical aspect of financial planning. A life policy will ensure that your loved ones are adequately taken care of in the event of your unexpected death. To choose the right life insurance policy, you need to pass explore the different policy types and find one that suits your individual needs.

There are various policy types to choose from, such as term life insurance, whole life insurance, and universal life insurance. Each of these policies has its advantages and disadvantages. Quick tips to consider when choosing a life insurance plan include determining how much coverage you need, understanding how long you need coverage for and assessing your budget. Take some time to explore the options available so that you can make an informed decision on the ideal life insurance plan for you.

Ensuring Your Future: Understanding Life Insurance Needs

Understanding your life insurance needs is crucial to ensuring that you and your loved ones are financially protected in the event of an unexpected tragedy. Experts recommend carrying life insurance with a death benefit of at least 10 times your annual income, but determining the appropriate amount for your unique financial situation can be tricky. Utilizing a life insurance calculator and consulting with a reputable provider can help you make informed decisions about securing adequate coverage for yourself and those who depend on you.

A Founder Who Bootstrapped Her Jewelry Business with Just $1,000 Now Sees 7-Figure Revenue Because She Knew Something About Her Customers Nobody Else Did

Meg Strachan, founder of the lab-grown jewelry company Dorsey, is a true inspiration for entrepreneurs everywhere. With just $1,000 in her pocket, she bootstrapped her business and made it to 7-figure revenue. How did she do it? By knowing something about her customers that nobody else did.

According to Amanda Breen, Strachan's success came from understanding her customer base on a personal level. She knew what they wanted and what they didn't want, and she used that knowledge to create a brand that resonated with them. This is an important lesson for anyone looking to start their own business – knowing your customer is key to success. And when it comes to life insurance, understanding your customer's needs and concerns can be the difference between closing a deal and losing a potential client. So take a page out of Meg Strachan's book and get to know your customers on a deeper level – it could be the key to unlocking your business's full potential.

Discovering the Various Life Insurance Options Available

Life insurance policies generally fall into two categories: term and permanent. Term policies are for a set timeframe, such as 1, 10, 15, 20 or 30 years. They offer a death benefit if the policyholder passes away during that time period. Permanent policies, on the other hand, provide coverage for the entire lifetime of the policyholder.

Final expense policies are an affordable type of permanent life insurance with a lower death benefit. They're designed to cover end-of-life costs like funeral expenses and outstanding debts. With so many life insurance options available, it can be overwhelming to choose the right one. By understanding each type of policy and your unique needs, you can easily determine which is best for you and your family.

Whether it's term or permanent life insurance or final expense policies, having any form of life insurance is vital to protect your loved ones in case of an unexpected tragedy. It provides financial support when it's needed most and ensures that those left behind can carry on without enduring undue financial hardship. Don't wait until it's too late – explore your options today and secure your future!

Frequently Asked Questions

What are the benefits of life insurance?

Life insurance provides financial security and peace of mind to your loved ones in the event of your unexpected death, as it can cover expenses such as funeral costs, outstanding debts, and loss of income. It can also be used as an investment tool for future savings or retirement planning.

Is life insurance a good way to build wealth?

No, life insurance is not a good way to build wealth. While it can provide financial protection for your loved ones, it is not an investment vehicle and does not generate significant returns. It is important to consider other investment options for building wealth.

Who is the policyholder in a life insurance policy?

The policyholder in a life insurance policy is the person who owns the policy and pays the premiums. They can also be the insured person or someone else who has an insurable interest in the insured's life.

Why is universal life insurance important?

Universal life insurance is important because it provides lifetime coverage and the ability to accumulate cash value, which can be used for emergencies or retirement. It also offers flexibility in premium payments and death benefit amounts.

Why is insurance important in financial planning?

Insurance is important in financial planning because it provides protection against unexpected events that can cause financial hardship. It allows individuals to transfer risk to an insurance company and have peace of mind knowing they are covered.

Featured Images: pexels.com